The Big Beautiful Blog

Stratus—formerly SkyBridge V2—is coming.

Surprise! 🎉 We've been building the next chapter of Aviator. A new era of omnichain support for crypto traders, app builders, digital creators, and game players is about to begin.

- SkyBridge V2 has evolved into Stratus.

- Stratus is a full-stack ecosystem: a universal settlement layer, a public node and relay system with Proof of Stake validation, a cross-chain bridge, a permissionless yield farm, a decentralized OTC desk, a powerful omnichain token launcher, and an AI-driven strategy engine.

- Stratus is being acquired and maintained by an independent entity.

- In exchange, AVI holders may convert their AVI to STRAT at a fair market value of $0.01 per AVI.*

- All converted AVI tokens will be burned, not sold on the market. This reduces total AVI supply, increasing scarcity as Aviator Arcade continues to develop enhanced tokenization features and omnichain support for builders, creators, and players.

How did we get here?

Aviator has been a journey of patience, grit, and perseverance. In January of 2024, we outlined our vision for SkyBridge, a universal protocol that would empower users, creators, builders, institutions, projects—anyone—to make their assets unchained, bypassing centralized control across the existing cross-chain infrastructure spanning Ethereum, L2s, sidechains, and other EVM-compatible networks.

We pioneered permissionless token bridging: our proof-of-concept was designed around the promise of allowing simple token deployments from one chain to another, and we brought that vision to life through the SkyBridge Pilot program on Base. To date, over 100 Ethereum tokens have been minted on Base without any permissions, development experience, operational oversight, or whitelisting from chain operators.

We invented Supersonic: the first bespoke system to bypass Optimism's cumbersome seven-day withdrawal requirement by leveraging a public liquidity pool for our native token.

We laid the groundwork for Unalloyed Liquidity: a proposed liquidity framework that allows users to freely supply any token from any supported network, or its corresponding Uniswap V4 liquidity NFT, and earn rewards for supporting the protocol.

We redefined operational security: completing two rigorous smart contract audits by Hacken, the industry leader in blockchain security oversight. To this day, we maintain an ongoing Bug Bounty program, active compliance, and safety monitoring in the US and EU.

The Evolution of Supersonic

What began as a clever workaround to centralized restrictions on the Optimism stack has evolved dramatically. Initially, it functioned as a liquidity pool that served as a buffer for long validation periods. However, we quickly realized that this could not scale. Supersonic had to evolve, and it did.

Supersonic is now an entirely custom transaction execution and settlement layer, supported by an independent, decentralized, Proof-of-Stake node network where anyone can easily operate a node, earning rewards by securing the network and validating transactions.

Market Research

In developing SkyBridge, we spent several weeks researching the evolving needs and trends of the crypto market. What we discovered is simple: people don't want another bridge; they want instant access to utility and opportunity.

Here’s what drives them:

- Higher yields – chasing better APYs across different ecosystems.

- Cross-chain arbitrage – capturing better prices on assets across multiple networks.

- Utility access – meeting minimums or gaining eligibility for whitelists, pre-sales, or chain-specific dApps (e.g., seed protocols on Arbitrum).

- Increase app support – bringing tokens from one chain to another to follow emerging trends before the hype fades.

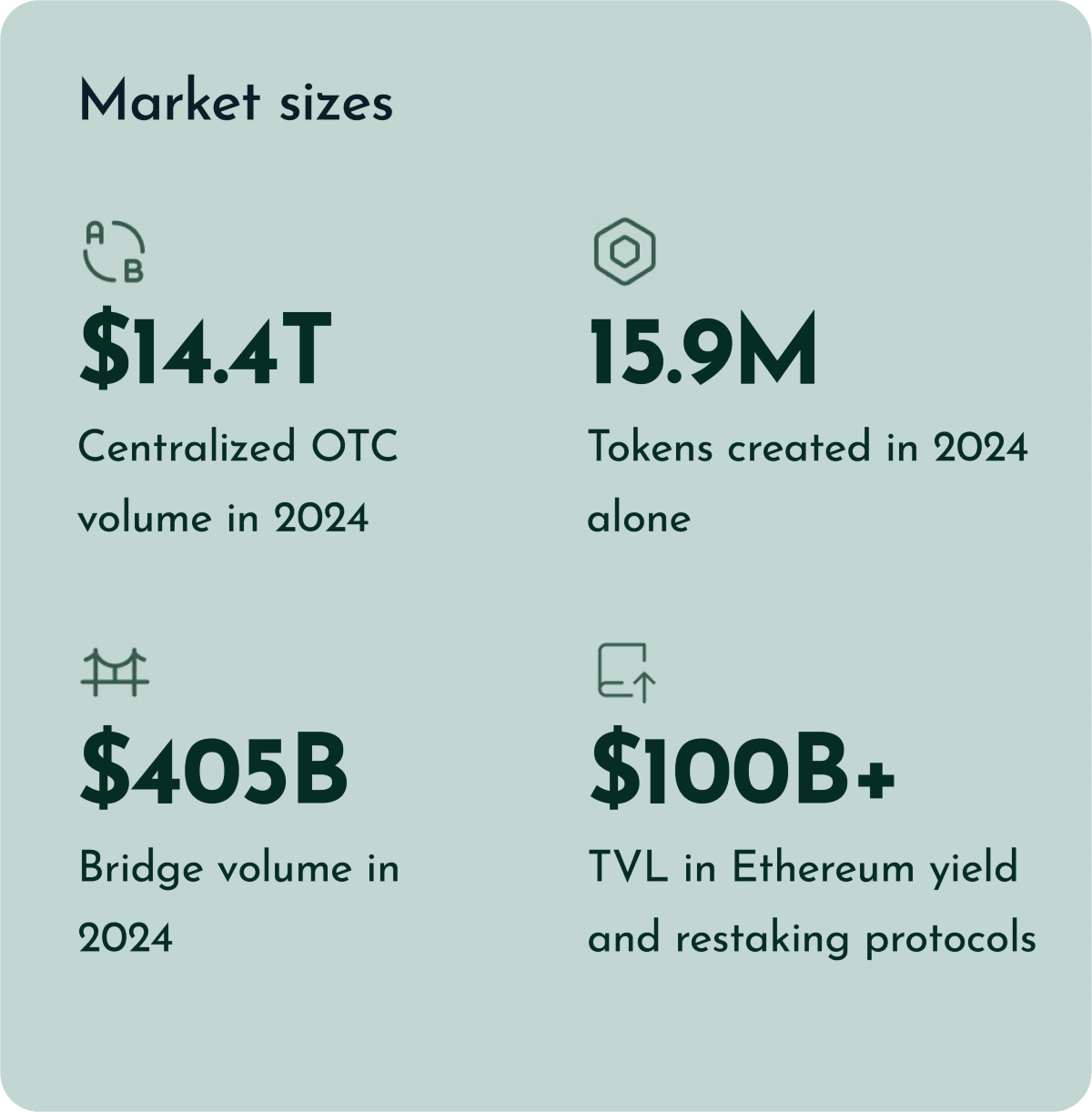

In 2024 alone, over 8M DeFi users moved $405B in assets across chains.

While much media attention has around the dominance of Bitcoin as an asset over the past few years, the reality is that DeFi is accelerating at an unprecedented pace.

- Onchain trading activity across EVM, Solana, SUI, Stellar, and other smart contract networks is at an all-time high.

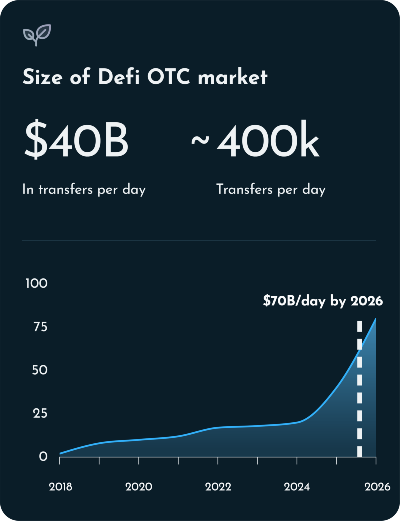

- The demand for OTC trading has, on average, doubled every 16 months.

- Token creation is surging, with 15.9M tokens created in 2024 alone.

- Protocols like AAVE, Maple, and Lido are breaking TVL records day after day.

- Funds like BitMine, SharpLink, and other DeFi treasury companies are racing to accumulate digital assets in what they envision as a fully tokenized future.

The problem with competitors' solutions

Users have many options to move their assets across networks, but they all fall short of user needs:

- Slow execution times – Crosschain transfers create significant friction for traders and app builders in an environment where every second counts.

- Centralization risks – Custodial solutions introduce security vulnerabilities, restrict access, and often charge higher fees for lesser operational security and reduced regulatory compliance.

- Limited support – Existing solutions rely on whitelisting assets (often just USDC and ETH), stifling new builders and locking users into closed ecosystems.

Here's how we're solving these problems

We've developed a revolutionary settlement layer, designed to support critical infrastructure for first and third-party applications. Here's a glimpse of what's possible:

- Build custom bridge frontends with chain-agnostic infrastructure.

- Offer a decentralized OTC desk for institutions and users alike.

- Create launchpad and fundraising platforms with multichain liquidity, smart contract functionality, and crosschain data transmission.

- Create omnichain reward pools for any project, powering staking or volume-based dApps.

- Instantly transmit arbitrary data across chains for building native multichain apps: games, yield, custody, socialFi, streaming, and more.

- Earn builder grants for building innovative apps that leverage the network's unique capabilities.

And the best part? It’s not just theoretical; we've already built it.

Today, we're introducing Stratus: the world's most robust transaction settlement and execution layer, for everyone.

If you want something done right, you must do it yourselves.

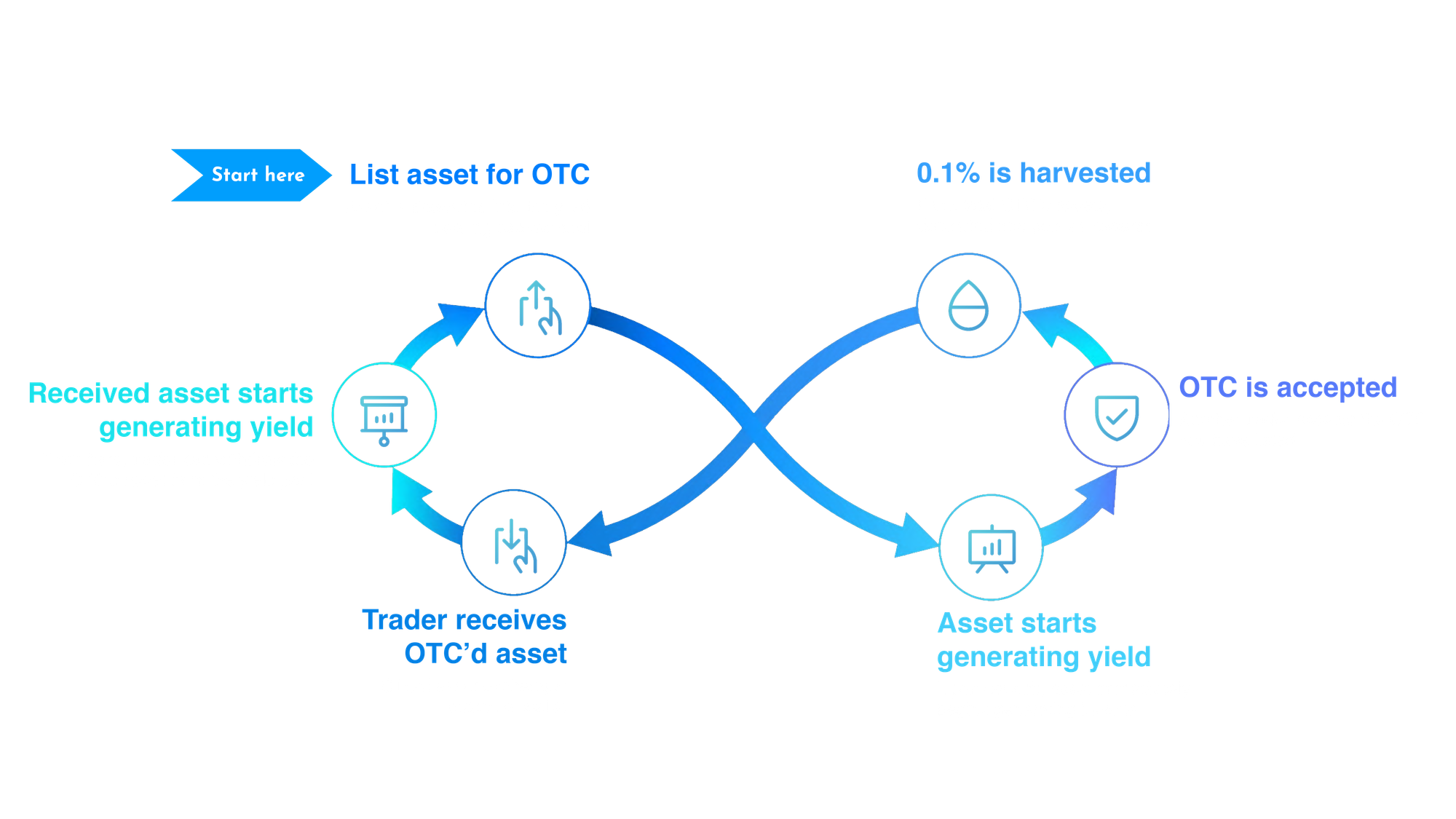

Stratus is a Liquidity Flywheel

Stratus is a liquidity and yield ecosystem where every product feeds the next.

Stratus Settlement Layer – Transmit tokens or data across chains that settle in seconds. Transactions are powered by public relayers that are so simple to set up, even a child could operate them.

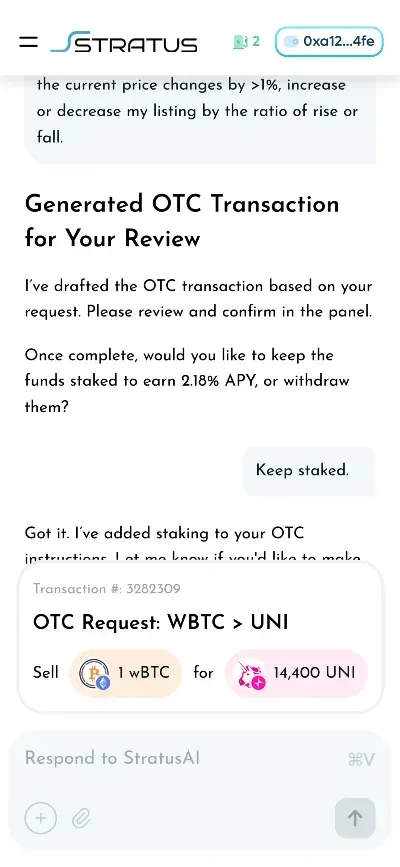

OTC Desk – The destination for real liquidity. Deeply staked assets, bridged liquidity, and AI-driven execution converge to enable frictionless OTC trades, earning yield while assets are pending sale.

Staking Pools – Attract and reward holders. Projects gain visibility through trending tiers, and users can re-stake LP tokens for double rewards, deepening platform commitment.

Token Launcher – Create a token in just a few clicks. 1% of the supply automatically feeds staking rewards over time, incentivizing projects to crowdsource liquidity, instantly creating utility for tokens launched on Stratus.

Bridge – Move assets and data freely. Bridge tokens or NFTs across chains, triggerable via AI, lowering barriers to participation.

Stratus AI – Unified control across all products over text or voice. Natural-language commands like “Stake my LP token” or “Sell on OTC in USDC” drive ease of use and increase velocity.

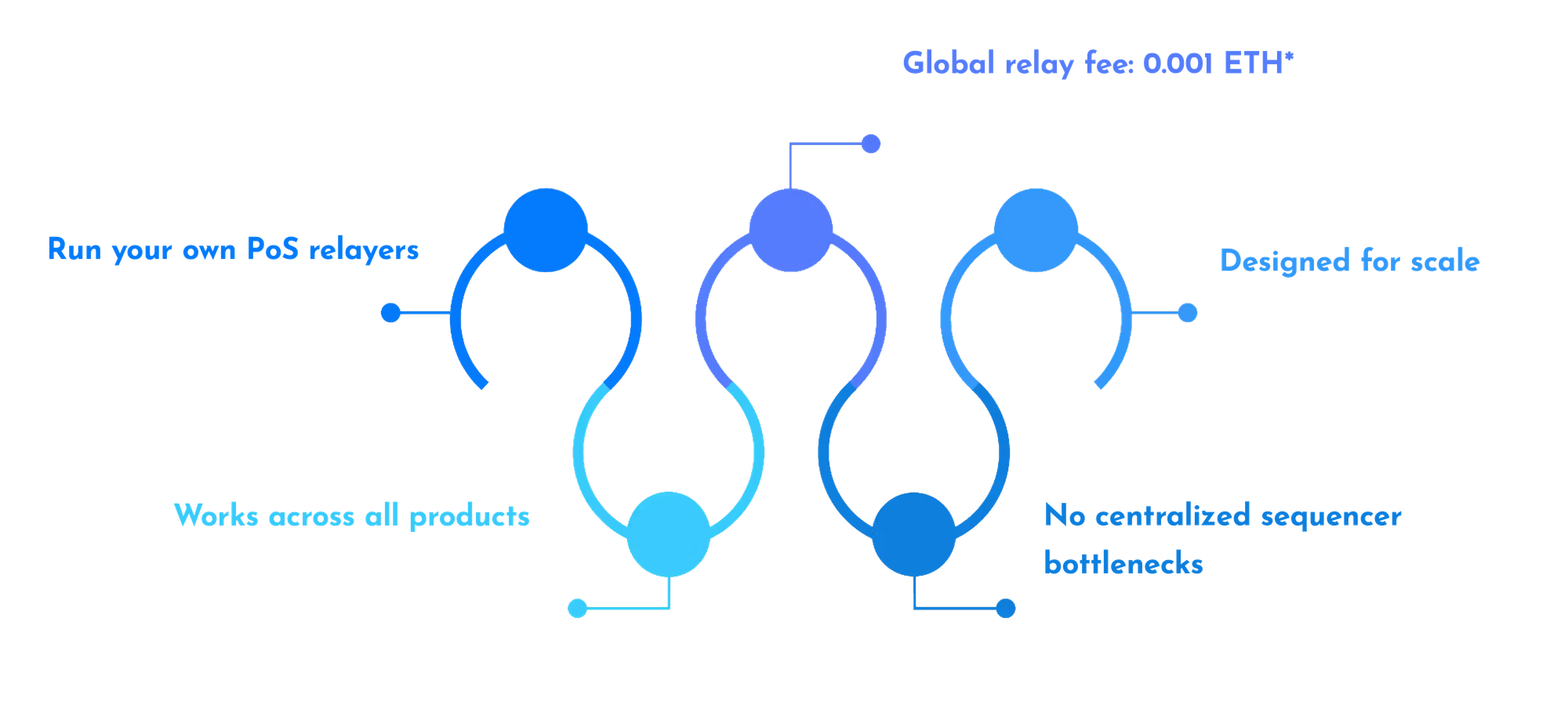

Stratus Settlement Layer

Stratus enables instant settlement of any asset to any supported network through the new Supersonic mode, the default transaction speed across all networks on the platform.

Users can transfer tokens and arbitrary data across chains fully permissionlessly. Any token is supported instantly, with no deployment necessary. Security is maintained by a decentralized network of relayers, where anyone can participate and run their own validator through a Proof of Stake security model. Best of all, there are no hardware or bandwidth requirements, as everything runs onchain. The more you stake, the more relayers you can run.

Stratus Bridge

Stratus Bridge enables seamless, Supersonic transfers across chains, with instant token support, multi-wallet portfolio management, and zero deployment friction.

- Instant support with any token, no need for deployment.

- Built-in multi-wallet asset management.

- Supports token + arbitrary data transfers across chains.

- Voice & AI commands: “Send 20 USDC from Base to my SOL wallet.”

- No liquidity requirements for bridging.

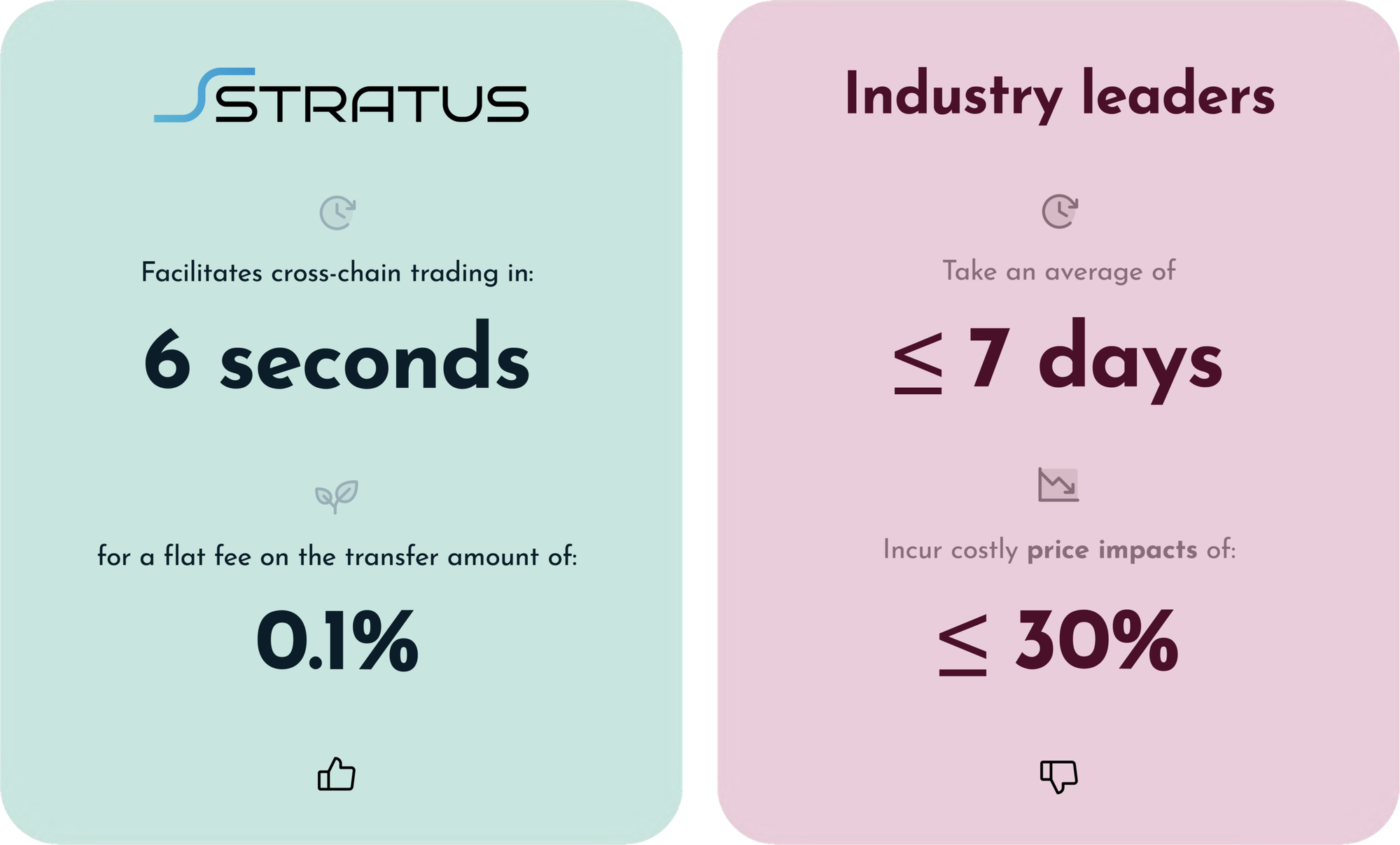

Bridging with Stratus is 60% cheaper and orders of magnitude faster than industry-leading bridges, with relayer fees at a flat 0.001 ETH and an average execution time of 6 seconds.

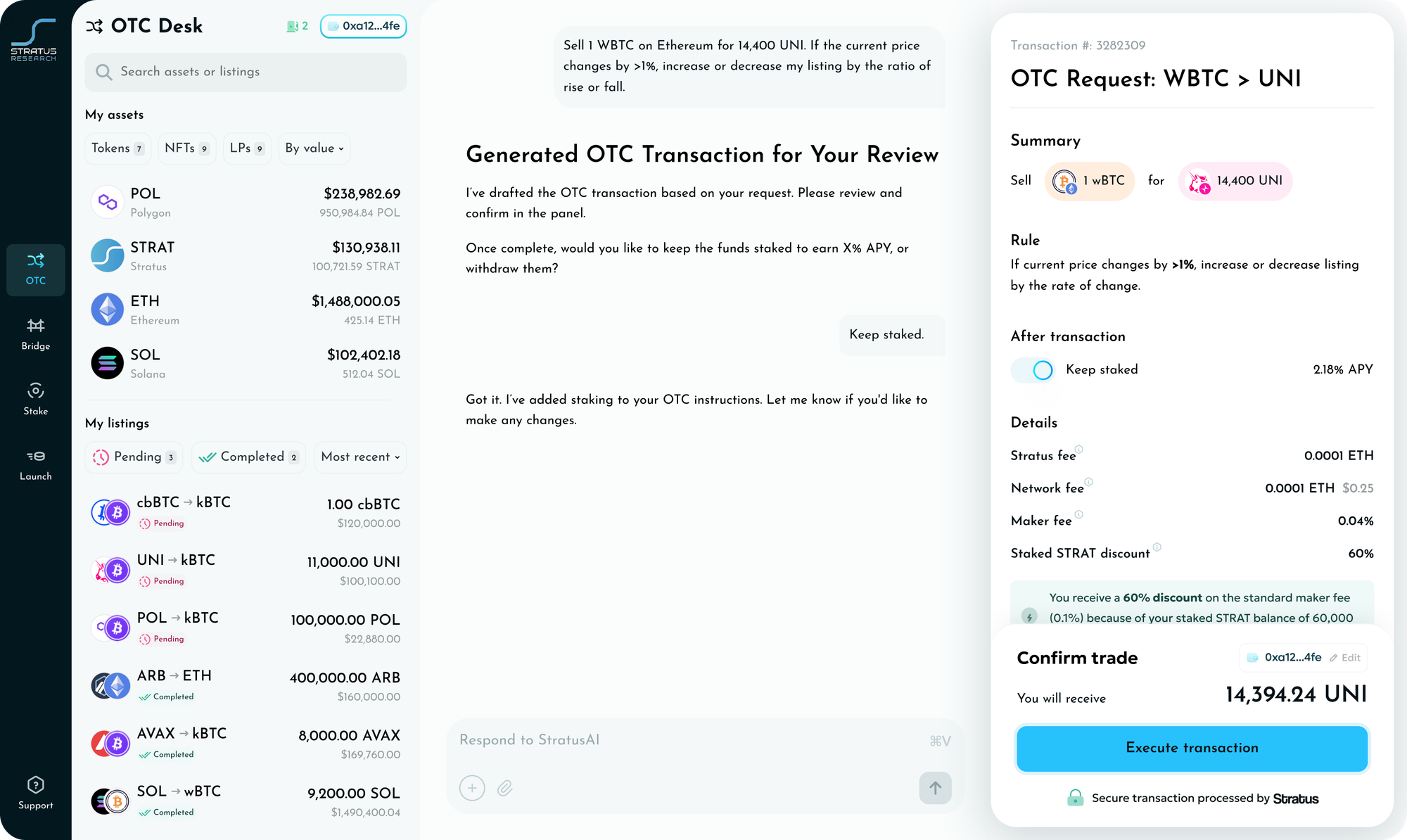

Stratus Crosschain Decentralized OTC Desk

Stratus opens up an institution-grade OTC Desk to anyone and any asset, enabling 6-second omni-chain trading for a low 0.1% fee.

At the core of Stratus is universal access. Regardless of accreditation or KYC status, users can access and interact with the protocol. Crosschain support is powered by Stratus’ settlement layer, while yield pools let users earn on their assets while OTC orders are pending. Deep liquidity across chains allows trading into any supported asset or network, and AI-led execution provides agentic control over OTC actions for seamless, global management.

By escrowing assets in staking pools that earn yield, Stratus offsets protocol fees while waiting for fulfillment, turning friction into a feature:

- Deposit assets into yield-bearing staking pools – Assets earn yield, turning friction into a feature and offsetting protocol fees.

- Place an OTC order – Assets remain in the yield-bearing pool until filled.

- Execute cross-chain trades instantly – OTC transactions settle in just 6 seconds, 200x faster than traditional desks (20+ minutes elsewhere).

- Contribute fees to the pool – 0.1% of each executed OTC trade is deposited into the yield pool.

- Earn yield while waiting – The longer the wait, the more yield is generated, effectively reducing user costs toward zero.

- No impermanent loss – Single-asset deposits remove this risk entirely.

- Lower fees with STRAT – Stake STRAT tokens to further reduce transaction fees.

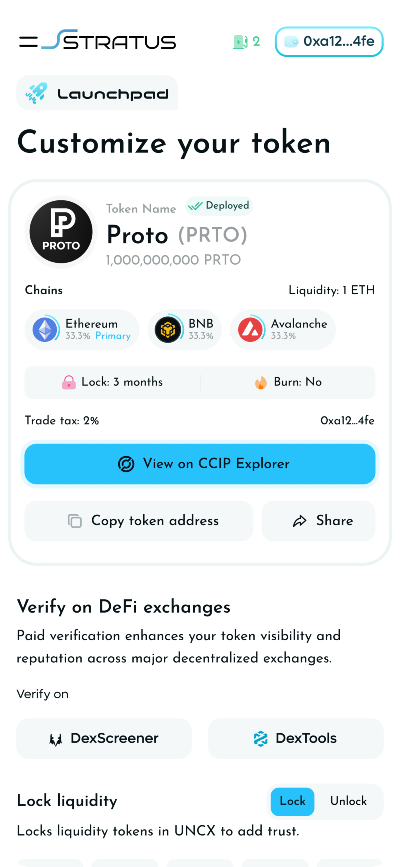

Stratus Token Launcher

The Stratus Token Launcher makes it effortless for projects to create and deploy tokens across multiple networks at once. Built-in liquidity provisioning, staking rewards, and trending boosts ensure your token launches strong and stays active. Stratus isn't just another token launchpad: it's the most efficient and robust token creation tool ever developed.

- Multi-chain deployment – Launch a token on one or many chains in a single transaction, all at the same contract address.

- Instant liquidity provisioning – Tokens are ready to trade immediately at launch on Uniswap V4.

- Chainlink CCIP compatibility – Supports standard cross-chain tokens via ERC-677.

- Auto-generated staking pool – Automatically sets up rewards for your token.

- Functional multichain tax & accounting functions – Handles complex tokenomics across networks.

- Full integration with Stratus Staking & LP platform – Seamlessly connects to the wider ecosystem.

- Integrated with UNCX liquidity lockers – Ensures secure liquidity locking from the same interface.

- Cost-effective – 10x cheaper than the next cheapest token creator at 0.001 ETH + 0.2% of minted supply.

- 1% of token supply added to reward ecosystem over time – Incentivizes community participation and growth.

Stratus Yield Farming

Stratus Yield Farming lets users earn passive income by staking any token or Uniswap V4 LP token across any supported chain:

- Chain-agnostic – Deposit and withdraw staking assets on any supported network.

- Instant pool creation – Projects can boost rewards and launch staking pools without bespoke solutions.

- Restake LP tokens for double yield – Combine rewards from platforms like Uniswap with Stratus.

- Dark Pools – Liquidity deposits are combined in a public pool to protect users from prying eyes.

- Crowdsource liquidity – Offer users yield to grow liquidity for new projects.

- AI-optimized strategies – Maximize yield based on market and wallet activity.

- Liquid staking by default – All tokens remain liquid while staked.

- Premium ads & trending slots – Highlight verified staking programs.

- Multiple verification tiers – Increase trust and credibility for token listings.

Stratus AI

Stratus AI gives users global control over the full ecosystem using natural language, executing transactions, optimizing positions, and unlocking insights instantly:

- Natural-language commands:

- “What’s the best APY on Stratus right now?”

- “Send all my ETH to Ink.”

- “List my cbBTC for 100K USDC on Solana.”

- Transaction execution & position optimization – Control your assets across chains seamlessly.

- Built-in coaching & smart helpdesk – Rapidly onboard users and bridge the skill gap from novice to expert.

A Massive Leap Forward for the Community

To provide the strongest value for AVI token holders, we have decided to allow Stratus Research, an independent partner, to acquire the technology behind what was formerly SkyBridge V2.

What does this mean for you?

Stratus is launching its native protocol token, STRAT. Staking STRAT secures the network through the relayer infrastructure.

Stratus is allowing AVI holders to convert their AVI to STRAT, at a value of $0.01 per AVI.*

AVI holders will earn boosted rewards in perpetuity on Stratus. All AVI collected via DEX liquidity fees will be redistributed to the community through Stratus staking. Aviator Arcade will be the first project to fully leverage Stratus technology for a fully chain-agnostic experience, gaining exclusive first-mover advantage and early access to lead the market in chain-agnostic gaming.

As a technology solutions company, Aviator may, from time to time, license or provide its proprietary solutions to third parties in exchange for various forms of consideration, including cash, digital assets, or other assets.

Aviator is planning to convert a portion of its treasury to STRAT tokens through the service described previously, burning AVI tokens and staking STRAT tokens to support the network, to foster the long-term development of the Stratus ecosystem, and maintain alignment between the platforms.

Do just once what others say you can't do, and you will never pay attention to their limitations again.

Going forward, Aviator will concentrate its full development efforts on Aviator Arcade, evolving it into a comprehensive gaming and social ecosystem that empowers players, creators, and communities across the onchain landscape.

We've updated our Terms of Service with details on this token migration service. Do not connect your wallets to any third-party websites claiming to be Aviator or Stratus. Stratus does not currently have any active social media platforms and is not a community-driven project; it is an infrastructure provider with future platforms for builder support and collaborations. Their social media outlets will be handled by their marketing team. Updates on STRAT tokemonics, schedules, and other information will come directly from Stratus.

- The only official domain for Aviator is aviator.ac.

- The only official domain for Stratus is stratus.one.

Today marks the beginning. Congratulations, Aviators, you made it. 🤝

*This program is voluntary and is dependent on available liquidity. Values are an estimate of targets and are subject to change without notice. Neither Aviator nor Stratus make any guarantees of fundraising or liquidity outcomes. Please review full terms before making any trading decisions.

Disclaimer: The content published on this site, including blogs, articles, and other published content, is provided for general informational purposes only and should not be construed as financial, investment, legal, or other professional advice. Aviator’s personnel are not broker-dealers, investment advisors, or financial professionals and do not issue or provide financial, investment, or legal advice. Aviator does not validate, verify, or endorse any claims, statistics, opinions, or information presented within these materials. Furthermore, Aviator does not perform due diligence on any featured projects, companies, or investments mentioned herein.

Purpose of Digital Assets: The AVI and STRAT tokens are issued as consumable utility tokens, designed to be used to access a service. Neither Aviator nor Stratus endorses any digital asset as a capital investment nor guarantees any financial outcomes of token performance or future availability. Ownership of any amount of AVI or STRAT tokens does not represent equity in any legal entity. AVI and STRAT token holders are not entitled to corporate voting rights, dividends, access to financial records, participation in stakeholder meetings, claims to assets, or any assumption of liabilities. Ownership or use of AVI or STRAT tokens, or any other tokens or digital assets issued by the companies, their subsidiaries, or partner companies, including through off-platform transactions, constitutes the usage of a service provided by us, and is subject to the issuer's full terms of service and usage.

No Endorsement or Responsibility: The inclusion of third-party projects, products, or services does not constitute endorsement or recommendation by Aviator. Any opinions expressed are those of the authors and do not necessarily reflect the views of Aviator. Aviator explicitly disclaims all liability for errors, omissions, or actions taken based on the content provided.

Investment Risks: Investing in cryptocurrencies and other digital assets involves significant risk, including the potential loss of your entire investment. Digital assets are highly volatile and speculative, and past performance is not indicative of future results. There is no guarantee of safety or recovery if complications arise, and you should carefully consider your investment objectives and risk tolerance before engaging in any investment activity.

Acknowledgment of Risks: By accessing this site, you acknowledge and accept these risks. Aviator assumes no responsibility for any losses, damages, or other consequences that may result from the use of this site, its content, or reliance on the information provided in blogs, articles, or other published content.

Consult Professional Advisors: Readers and users are strongly encouraged to seek independent advice from qualified professionals before making any financial, legal, or investment decisions based on the information contained herein.

Terms of Service: By using the website and services, you agree to be bound by our full terms and conditions and privacy policy. Ownership or use of Aviator tokens, or any other tokens or digital assets issued by Aviator Technologies, LLC, its subsidiaries, or partner companies, including through off-platform transactions, constitutes a service provided by us, and is subject to these terms, which outline risks and limitations of liability. Aviator values your privacy and does not sell your personal data.